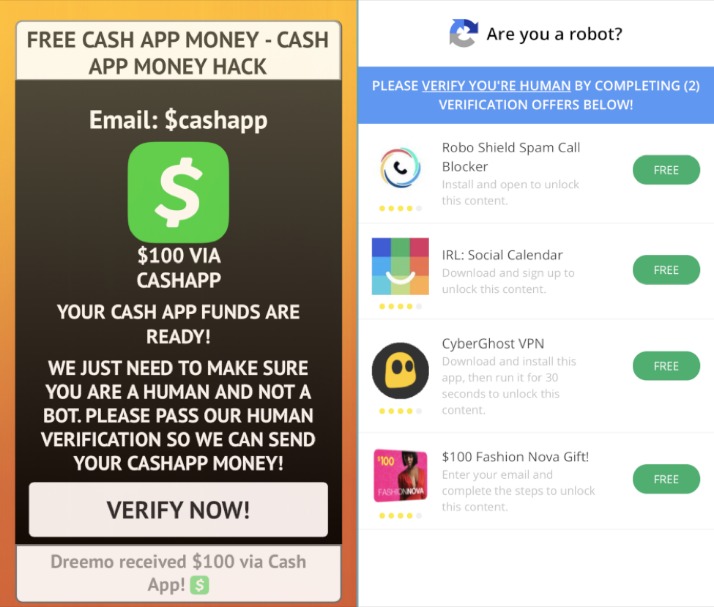

Once the scammers get a hold of this information, they can use it to steal your money or commit fraud. Cash App scams often involve links to unsecured websites made to look legit. Clicking suspicious links can not only drain your wallet, but it can damage your device or send you to the dark corners of the internet. Our website safety check guide can teach you the warning signs to watch out for.

How Common Are Dark Web Cash App Hacks?

Here are the latest Cash App scams to be aware of and how to protect yourself from scammers. Stairwell’s Mike Wiacek demonstrates Stairwell’s file analysis and threat detection platform to Risky Business host Patrick Gray. Besides encrypting data, the group is also known to steal files for secondary extortion attempts, although it does not operate a dark web data leak site like other ransomware crews. Follow this up with the purchase protections or seller protections pages for a sound foundation.

- If you’re looking for a way to hack into the dark web and cash out, you might want to check out the Dark Web Cash App Hack.

- Vendor Privileged Access Management (VPAM) is a cybersecurity strategy that focuses on controlling and securing third-party access to an organization’s…

- Instances of a cash app hack have been documented, where unauthorized individuals gain access to users’ accounts.

- The real estate sector has experienced a spate of shocking cyber incidents in recent times.

- After earning enough trust, the scammer fabricates an emergency and asks their target for help.

- And with our CashApp Hack Safe Transfers made via CashApp Exchange Scripts, you can rest assured that your transfers will be secure and reliable.

Can I Recover Lost Funds Due To A Hack?

Identity thieves target people’s personal information, online accounts, Social Security numbers, and a bunch of other types of personally identifiable information. For Cash App users, phishing is the No. 1 risk, which could lead to the hacking of their Cash App account and loss of funds. Cybercriminals on the dark web may attempt to hack into Cash App accounts to gain access to users’ personal and financial information. This can result in unauthorized transactions, identity theft, and other forms of financial fraud. In some cases, hackers may even sell stolen Cash App credentials on the dark web for others to use.

However, they are hard to reach, and because of that, they’re easy to impersonate. The scammers created a fake Zelle account in her name using the code from her bank, and they were able to access both her savings and checking accounts. Your Wi-Fi network is another handy access point that hackers use to infiltrate your computers, steal your identity, and grab your personal details. As mentioned earlier, Cash App uses data encryption to secure personal data while in transit to its servers. The dark web Cash App hack is a type of cyber attack that targets the Cash App’s user database. Hackers gain unauthorized access to the database and steal sensitive information, such as users’ names, email addresses, phone numbers, and credit card details.

Understanding Cash App And Its Vulnerabilities

These avenues offer more reliable and sustainable ways to enhance your financial well-being. It’s important to weigh the potential gains against the possible legal and ethical ramifications. Consider the long-term implications and seek legal advice to ensure compliance with laws and regulations before attempting the Cash App Glitch or any similar activities. Furthermore, it’s important to consider the ethical implications of attempting the Cash App Glitch. While it may seem tempting to take advantage of a potential opportunity to increase your funds, it is essential to consider the fairness and legality of such actions. Explore the underground world of online commerce (Darknet Markets) with our dark web marketplace.

Monitor Your Account Regularly

It’s what allows systems to communicate with each other securely, without human… WebAuthn is the API standard that allows servers, applications, websites, and other systems to manage and verify registered users with passwordless… Vulnerability management (VM) is the proactive, cyclical practice of identifying and fixing security gaps. In October 2023, Truist Bank suffered a cybersecurity event that exposed the private information of its employees. When it comes to modern software development, two terms that are often used interchangeably are Service-Oriented Architecture (SOA) and Microservices….

Sending Group Texts On Pixel 6: The Definitive Guide

Meanwhile, you can file a dispute for the transaction with your bank if you’ve linked your Cash App account to a debit card or credit card. By staying vigilant and taking proactive steps to secure your Cash App account, you can minimize the risk of falling victim to a dark web cash app hack. Remember, it’s always better to be safe than sorry when it comes to protecting your hard-earned money. A dark web Cash App hack is a type of cybercrime where a hacker gains unauthorized access to a Cash App account and steals money or personal information.

Working Darknet Market

It enables the use of common devices to authenticate to online services on both mobile… In August 2024, one of the largest asset managers, Fidelity Management & Research, fell victim to a data breach. The Experian data breach proves that no organization is too big for attackers to target. In today’s world, cyber threats are becoming more sophisticated, and even the most robust security measures cannot guarantee total protection.

On the dark web, hackers offer services to infiltrate accounts and steal funds from popular payment platforms like Cash App. These hackers exploit vulnerabilities in the system to gain access to users’ accounts and siphon off money without their knowledge. Cash App is a popular mobile payment service that allows users to send and receive money, as well as make purchases online or in-store.

MOVEit Breach Creates More Victims; 105k Records Stolen From Insurance Group

- The allure of the Cash App Glitch and the promise of easy financial gains can be tempting.

- In February 2024, a ransomware gang hacked into Change Healthcare systems, a subsidiary of UnitedHealth’s Optum.

- “Cash flipping” scammers use Cash App because the money is transferred instantly and can’t be returned.

- If you notice phone hacking signs, stop using Cash App and any other payment app immediately.

However, with the rise of such apps, there has also been an increase in digital threats, such as a dark web Cash App hack. If you were accidentally sent money on Cash App, this could be part of a social engineering scam through Cash App. Scammers will deposit money in your Cash App account “by accident”, as part of a plan to gain your trust, or as a way to lure you into conversation (which can lead to other scams). They may even claim it was a mistake and ask you to refund them the amount they sent. Install free Avast Secure Browser to help bank securely, protect your personal data, and stay private online.

Steps To Take If You’re A Cash App User

These types of hacks constitute major security breaches — enough to make the news. But if you think you’re immune to such obvious tactics, even Jeff Bezos was once hacked in this way. These messages are a pain, and you might get careless — thankfully, it’s possible to stop unwanted text messages. It’s a world where heroes and villains traded places and could even be the same people. Criminals will enter transactions for high-price items like sublets, pet sales, or vehicles.

How Can I Identify Phishing Attempts?

In March 2023, Discord, one of the world’s most popular communication platforms among online communities, suffered a breach that impacted nearly 200 user… In February 2024, JPMorgan Chase reported that it discovered a data breach affecting the personal information of nearly half a million customers…. Advanced threat protection is a type of cybersecurity dedicated to preventing pre-planned cyberattacks, such as malware or phishing. The fact that a former employee caused Cash App’s data breach highlights the importance of implementing tight access controls within an organization. Using the principle of least privilege access is one way your organization can prevent such a scenario from occurring.